International Property Guides: A Comprehensive Guide to Real Estate Markets Around the World

International Property Guides

Investing in real estate abroad can be a lucrative opportunity for investors seeking diversification, capital appreciation, or rental income. However, navigating the nuances of each country’s real estate market can be a daunting task. That’s where international property guides come in – providing a comprehensive overview of each country’s real estate market, property prices, regulations, and cultural norms.

International property guides are an essential resource for investors looking to invest in real estate abroad. Here are some key reasons why:

- Gain insight into the local market: International property guides can provide investors with a deep understanding of the local real estate market, including property prices, rental yields, and demand.

- Identify opportunities: By studying international property guides, investors can identify emerging real estate markets or specific types of properties that offer attractive investment opportunities.

- Manage risks: International property guides can help investors navigate the local regulatory landscape, understand any legal requirements, and mitigate potential risks associated with investing in foreign real estate markets.

Example of market overview

Example of market overview, legal requirements, and investment opportunities broken down by continent and region for each of the regions in: Asia acific Europe North America South America Africa.

| Continent | Region | Real Estate Market Overview | Legal Requirements | Investment Opportunities |

|---|---|---|---|---|

Asia Pacific | East Asia | Strong demand for luxury properties in cities like Tokyo, Hong Kong, and Shanghai. Increasing interest in resort properties in Bali and Phuket. | Foreigners are often restricted from owning land in many East Asian countries, but can lease properties for long terms. | Growing middle class and increasing urbanization offer opportunities for rental properties and development projects. |

Asia Pacific | Southeast Asia | Growing interest in real estate investment in countries like Vietnam, Thailand, and Cambodia. Singapore is a popular hub for commercial real estate investment. | Foreigners can own properties in most Southeast Asian countries, but there may be restrictions on land ownership. | Increasing urbanization and growing economies present opportunities for development projects and rental properties. |

Europe | Western Europe | Mature real estate markets in countries like France, Germany, and the UK. Spain and Portugal offer more affordable options. | Foreigners can own properties in most Western European countries. | Commercial real estate investment opportunities in major cities, as well as opportunities for development projects in less developed areas. |

Europe | Eastern Europe | Emerging real estate markets in countries like Poland, Czech Republic, and Romania. | Foreigners can own properties in most Eastern European countries. | Affordable real estate prices and growing economies offer opportunities for rental properties and development projects. |

North America | United States | Large and diverse real estate market, with opportunities for both residential and commercial investment. | Foreigners can own properties in the US, but may face additional taxes and legal requirements. | Strong demand for rental properties, as well as opportunities for commercial real estate investment in major cities. |

South America | Brazil | Growing real estate market, with opportunities for both residential and commercial investment. | Foreigners can own properties in Brazil, but may face additional taxes and legal requirements. | Strong demand for rental properties, as well as opportunities for commercial real estate investment in major cities. |

Africa | North Africa | Emerging real estate markets in countries like Morocco, Egypt, and Tunisia. | Foreigners can own properties in most North African countries. | Growing tourism industry offers opportunities for resort properties, as well as development projects in urban areas. |

Africa | Sub-Saharan Africa | Growing real estate markets in countries like Nigeria, Kenya, and Ghana. | Foreigners may face restrictions on land ownership in some Sub-Saharan African countries. | Rapid urbanization and growing middle class offer opportunities for development projects and rental properties. |

Note

The information in this table is for illustrative purposes only and should not be taken as investment advice. Real estate markets and legal requirements can vary widely by country and region, and it is important to conduct thorough research and seek professional advice before making any investment decisions.

Understanding Profit and Loss Statements for International Property Investments

Overview

Europe

Europe is a popular destination for property investment, with many countries offering a stable economic and political environment, as well as attractive lifestyle options. Some popular countries for property investment in Europe include France, Spain, Italy, and Portugal. In each country’s section of the guide, you can expect to find information on the property market, legal and tax considerations, and any cultural nuances to keep in mind when buying property.

Some of the most popular countries for real estate investment in Europe include:

- Spain: Spain’s real estate market has rebounded in recent years, with strong demand from both domestic and international buyers. The country’s coastal regions are particularly popular among foreign investors, with many seeking vacation homes or rental properties.

- France: France is known for its luxury real estate market, with many investors flocking to Paris and the French Riviera. However, the country also offers affordable investment opportunities in cities such as Lyon and Bordeaux.

- Italy: Italy is a popular destination for second-home buyers, with investors drawn to the country’s rich history, culture, and cuisine. Popular investment destinations include Tuscany, Umbria, and the Amalfi Coast.

- Portugal: Portugal’s real estate market has seen significant growth in recent years, with investors attracted to the country’s affordable prices and favorable tax laws. The Algarve region is particularly popular among foreign buyers.

- United Kingdom: Despite the uncertainty surrounding Brexit, the UK remains an attractive destination for real estate investment. London continues to be a top investment destination, but other cities such as Manchester and Birmingham are also seeing growth.

Asia Pacific

Asia is a rapidly growing market for property investment, with many countries experiencing strong economic growth and increasing demand for housing. Some popular countries for property investment in Asia include Thailand, Malaysia, and Singapore. In each country’s section of the guide, you can expect to find information on the property market, legal and tax considerations, and any cultural nuances to keep in mind when buying property.

Some of the most popular countries for real estate investment in this region include:

- Japan: Japan’s real estate market is known for its stability and strong rental yields. The country’s major cities, such as Tokyo and Osaka, offer a range of investment opportunities.

- China: China’s real estate market is the second-largest in the world, with opportunities in both residential and commercial property. However, navigating the local regulations and restrictions can be challenging for foreign investors.

- Australia: Australia’s real estate market is known for its stability and strong capital growth. The country’s major cities, such as Sydney and Melbourne, are popular investment destinations.

North America

North America offers a diverse range of property investment opportunities, from bustling urban centers to scenic rural areas. Some popular countries for property investment in North America include the United States, Canada, and Mexico. In each country’s section of the guide, you can expect to find information on the property market, legal and tax considerations, and any cultural nuances to keep in mind when buying property.

Some of the most popular countries for real estate investment in North America include:

- United States: The United States has a large and diverse real estate market, with opportunities in cities such as New York, Los Angeles, and Miami. Investors can choose from a range of property types, including residential, commercial, and industrial.

- Canada: Canada’s real estate market is known for its stability and affordability, with popular investment destinations including Toronto, Vancouver, and Montreal. The country’s strong economy and political stability make it an attractive destination for foreign investors.

- Mexico: Mexico’s real estate market offers a range of investment opportunities, from luxury beachfront properties to affordable rental units. The country’s proximity to the United States makes it a popular destination for American investors.

South America

South America offers a unique and vibrant culture, along with a range of property investment opportunities. Some popular countries for property investment in South America include Brazil, Argentina, and Chile. In each country’s section of the guide, you can expect to find information on the property market, legal and tax considerations, and any cultural nuances to keep in mind when buying property.

Some of the most popular countries for real estate investment in Africa include:

- Brazil – With a growing economy and a large population, Brazil’s real estate market offers a range of investment opportunities. The major cities, such as Sao Paulo and Rio de Janeiro, offer high rental yields and potential for capital appreciation.

- Colombia – Colombia’s stable political climate and growing economy make it an attractive destination for real estate investment. The major cities, such as Bogota and Medellin, offer high rental yields and potential for capital appreciation.

- Chile – Chile’s stable political climate and growing economy make it an attractive destination for real estate investment. The major cities, such as Santiago and Valparaiso, offer high rental yields and potential for capital appreciation.

Africa

Africa is a rapidly developing market for property investment, with many countries experiencing strong economic growth and increasing demand for housing. Some popular countries for property investment in Africa include South Africa, Morocco, and Egypt. In each country’s section of the guide, you can expect to find information on the property market, legal and tax considerations, and any cultural nuances to keep in mind when buying property.

Some of the most popular countries for real estate investment in Africa include:

- South Africa – With a growing economy and a stable political climate, South Africa’s real estate market offers a range of investment opportunities. The major cities, such as Johannesburg and Cape Town, offer high rental yields and potential for capital appreciation.

- Morocco – Morocco’s growing tourism industry and stable political climate make it an attractive destination for real estate investment. The major cities, such as Casablanca and Marrakech, offer high rental yields and potential for capital appreciation.

- Kenya – Kenya’s growing economy and stable political climate make it an attractive destination for real estate investment. The major cities, such as Nairobi and Mombasa, offer high rental yields and potential for capital appreciation.

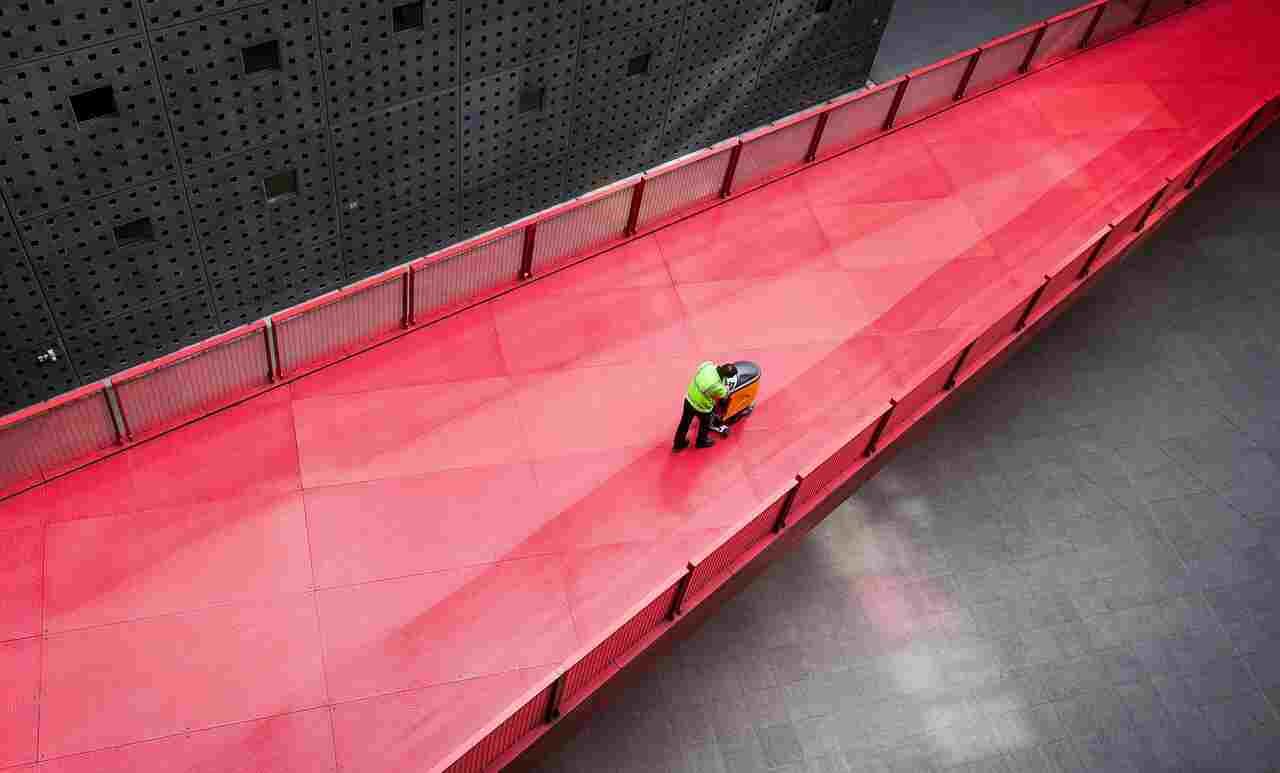

Photo credit: Sammiliao via Pixabay