Commercial Building and the Uses of Commercial Property

Exploring Commercial Building Properties and Their Diverse Uses

A business premises can be used to sell, store or manufacture goods, as well as to provide services. A commercial building is an enclosed structure designed to be occupied by businesses or organizations. Building codes tend to be stricter for commercial buildings than residential ones, as on matters of accessibility and in the United States are usually limited to commercial only zoning districts. Here are some common examples of commercial buildings:

- Stores

- Restaurants

- Professional office buildings

- Healthcare facilities such as doctors’ offices, dental clinics, and optometry practices

- Hotels (excluding extended stay hotels)

- Schools, especially private educational institutions

- Land: This category encompasses investment properties ranging from undeveloped rural land poised for future development to infill land within urban areas, pad sites, and more.

- Industrial: This category includes warehouses, expansive research and development facilities, cold storage units, and distribution centers.

Categories of Commercial Real Estate

Commercial real estate encompasses a wide range of property types, each serving distinct purposes and industries:

| Category | Examples |

|---|---|

| Hospitality | hotels, public houses, restaurants, cafes, stadiums, sports venues, nightclubs, amusement parks, movie theaters |

| Retail | retail stores, convenience stores, shopping malls, shops, showrooms |

| Office | office buildings, serviced offices |

| Healthcare | medical centers, hospitals, nursing homes, dispensaries |

| Multifamily (apartments) | multifamily housing buildings |

| Educational | schools, colleges, universities |

| Industrial | factories, warehouses, workshops, automobile repair shops. |

Of these, only the first five are classified as being commercial buildings. Residential income property may also signify multifamily apartments.

Tax Considerations

When it comes to real estate valuation, there are differences between residential real estate and commercial real estate. While owner-occupied residential properties are generally valued using the real value method, commercial and rental properties are usually valued using the discounted earnings method.

Commercial real estate is to be distinguished from residential real estate and special real estate in terms of treatment in tax law (sales tax, depreciation), in the area of financing and in building law. However, due to its nature, a property can serve both residential and commercial purposes (e.g. holiday home, office, loft, studio, farm) and then belongs to the mixed-use properties.

Understanding the tax implications of commercial real estate is crucial for property owners and investors. Key aspects include:

- Valuation methods: While owner-occupied residential properties are typically valued using the real value method, commercial and rental properties are often assessed using the discounted earnings method.

- Tax treatment: Commercial real estate is subject to distinct tax treatment compared to residential and special real estate, affecting aspects such as sales tax and depreciation.

- Financing and building regulations: Commercial properties are governed by specific financing and building regulations, reflecting their unique nature and intended use.

- Mixed-use properties: Some properties serve both residential and commercial purposes, such as holiday homes, offices, lofts, studios, and farms, falling under the category of mixed-use properties.

By understanding the diverse uses and tax implications of commercial properties, stakeholders can make informed decisions regarding investments, acquisitions, and property management strategies.

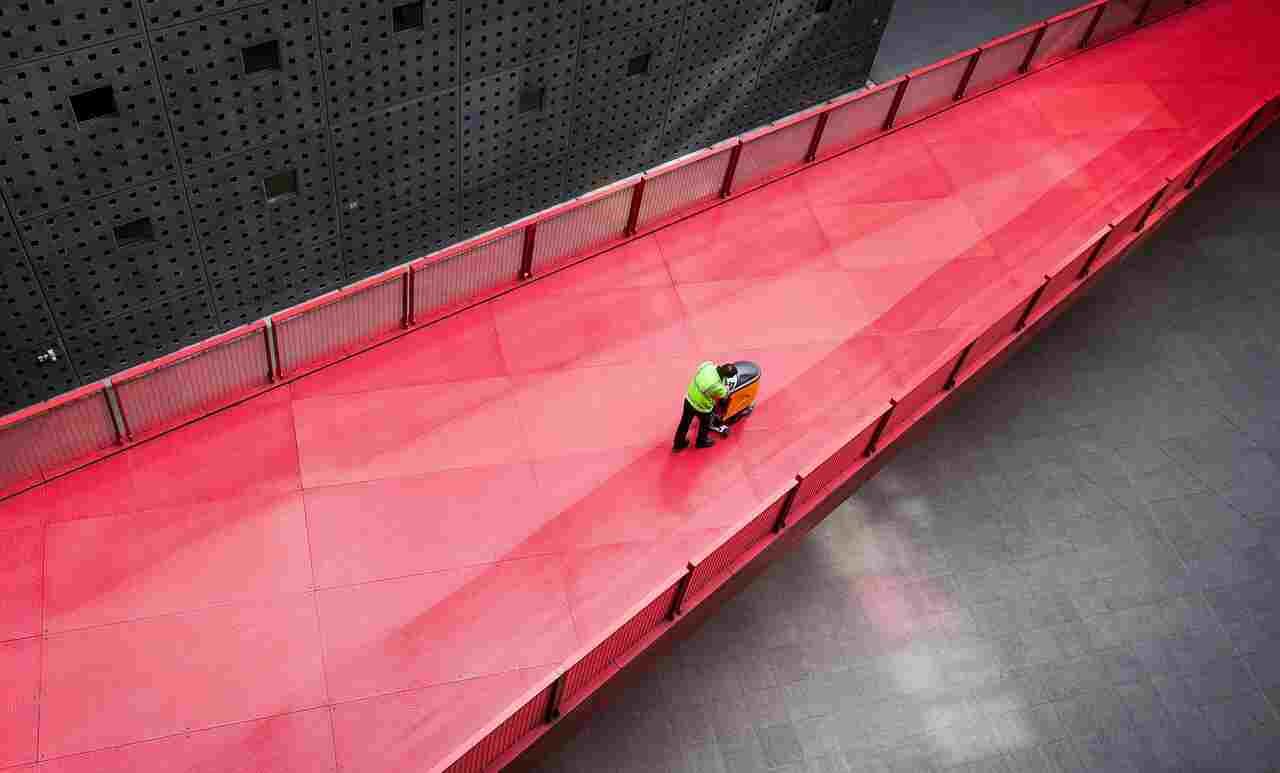

Photo credit: Foundry via Pixabay