Benefits and Risks of Investing in Commercial Real Estate

The Benefits and Risks of Investing in Commercial Real Estate

Investing in commercial real estate is a popular and lucrative option for many investors. Commercial real estate refers to any property used for business purposes, such as office buildings, retail stores, warehouses, and hotels. While there are many benefits to investing in commercial real estate, there are also some risks that must be considered. In this article, we will explore the benefits and risks of investing in commercial real estate and provide some examples to help illustrate these points.

Benefits of Investing in Commercial Real Estate

Steady Income: One of the main benefits of investing in commercial real estate is the potential for steady rental income. Commercial tenants typically sign long-term leases, which means investors can rely on a steady stream of rental income for several years. Additionally, commercial properties tend to generate higher rental income than residential properties, which can make them a more lucrative investment option.

Appreciation: Another advantage of investing in commercial real estate is the potential for property appreciation. As the property value increases over time, investors can sell the property for a profit. This appreciation can be due to various factors, such as the location of the property, economic growth in the area, and improvements made to the property.

Tax Benefits: Commercial real estate investors can also benefit from various tax deductions and benefits. For example, investors can deduct the cost of property repairs and improvements, as well as property depreciation. Additionally, investors can use a 1031 exchange to defer taxes when selling a property and reinvesting the profits into another property.

Diversification: Investing in commercial real estate can also provide diversification for investors. Commercial real estate is not closely correlated with other asset classes, such as stocks and bonds, which can provide investors with a hedge against market volatility.

Understanding Profit and Loss Statements for International Property Investments

Risks of Investing in Commercial Real Estate

High Initial Costs: Investing in commercial real estate typically requires a significant amount of upfront capital. This can include the down payment, closing costs, and other expenses associated with purchasing and managing the property. Additionally, commercial properties may require ongoing maintenance and repairs, which can add to the overall cost of the investment.

Market Volatility: Commercial real estate is not immune to market volatility, and economic downturns can lead to decreased demand for commercial space. This can result in higher vacancy rates and lower rental income, which can impact the overall profitability of the investment.

Tenant Risk: Commercial real estate investors are also subject to tenant risk. If a tenant defaults on their lease or goes out of business, this can result in lost rental income and additional expenses associated with finding a new tenant. Additionally, tenants may require expensive build-out or customization of the space, which can add to the overall cost of the investment.

Regulatory Risk: Commercial real estate investors must also be aware of regulatory risk. Changes in zoning laws or building codes can impact the profitability of a property, and environmental regulations may require costly remediation efforts.

Airbnb like platform for office spaces | Find Flexible Solutions

Examples of Investing in Commercial Real Estate

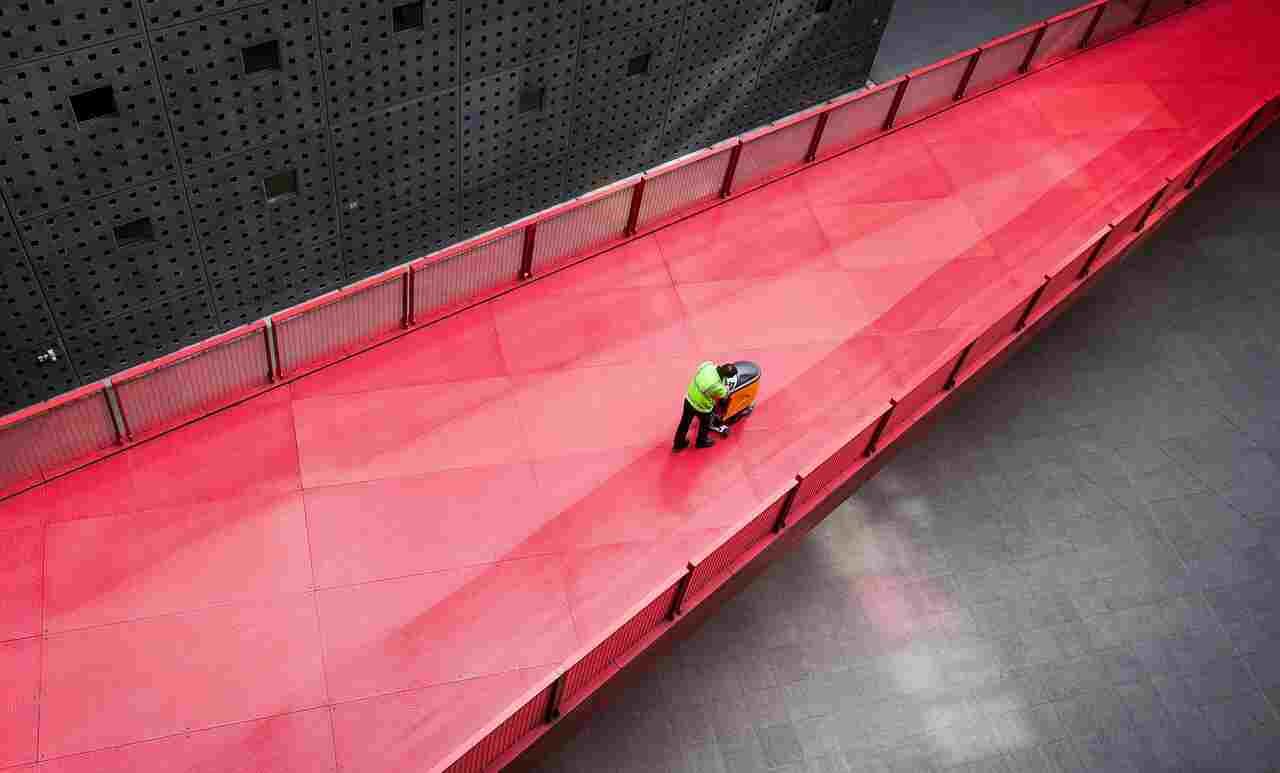

Investing in commercial real estate can include office buildings, retail space, and industrial properties.

Office Buildings

Investing in office buildings can provide steady rental income and appreciation potential. For example, the Willis Tower in Chicago was purchased by Blackstone for $1.3 billion in 2015 and sold for $1.7 billion in 2020.

Retail Space

Retail space, such as shopping malls and strip malls, can also be a lucrative investment. However, the COVID-19 pandemic has had a significant impact on the retail industry, and investors must carefully consider the potential risks before investing in this type of property.

Industrial Properties

Industrial properties, such as warehouses and distribution centers, have become increasingly popular in recent years due to the growth of e-commerce. For example, Prologis, a real estate investment trust (REIT), owns over 1 billion square feet of industrial space and has seen steady growth.

Sources: PinterPandai, Prideview Group, Avistone

Photo credit: ArtisticOperations via Pixabay